Increase your Salary Just by Opening a Savings Bank Account!

Money brings more money! Let your Money work for you by this simple step!

Bank account is one of the most widely used financial product and selecting it correctly is the first step in proper money management.

Generally Savings accounts are used to park money and not as an investment option like a FD (Fixed Deposit) . But What if we can get the investment benefits of FD (higher interest rates, no hidden charges) in a savings account ?

This higher interest earned is easy income for you and all you need to do to get this extra income is change your Savings account provider to DBS Bank. We also have a comparison of best salary accounts as linked below.

Best Salary Accounts in India for 2019 Comparison

Existing Banks vs DBS Bank Rates

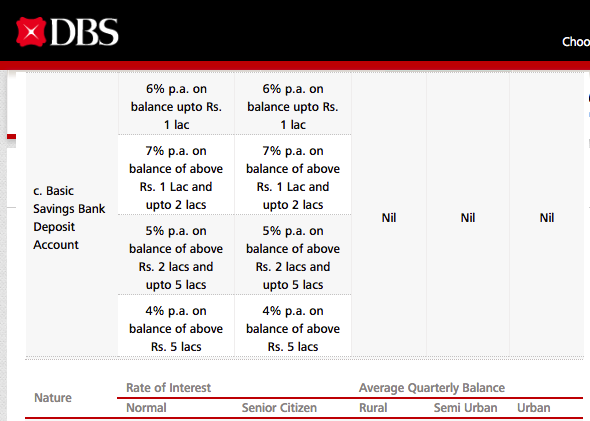

Your current bank or salary account can fetch you an interest rate of only around 3.5% (SBI, ICICI, HDFC, Bank Of Baroda, etc) to at maximum 5% (Kotak, YES Bank) . But DBS Changes the scenario here, as it offers an interest rate of 6% upto 1 Lakh and 7% on above 1 lakh balance in savings account. Which is as good as the fixed deposit rates of some PSBs.

Also, Since the interest is calculated daily, you earn a good interest even if the money in your account is there only for a single day.

Here’s a simple Table which will show you how much money you will earn by keeping your money in DBS Account as compared to a normal salary account (ICICI, SBI, HDFC) which do not pay any interest for corporate salary accounts –

[CP_CALCULATED_FIELDS id=”6″]

Earnings as much as 12% of your Monthly Salary

As shown in the above calculator, you earn almost 12% of your monthly salary just by using DBS.

Now, 12% of monthly income may not be a big amount in larger scheme of things (your annual salary). But this 12% can easily sponsor a big or small trip with your friends and family or you can use this money for your Birthday party treat without hampering your birthday month budget.

The uses for this money are many like investing, food, travel and efforts are almost none. Besides , the free money the DBS Account also has many other benefits such as –

Benefits of DBS Salary Account –

- Zero ATM Withdrawal charges from any ATMs even for Other Banks

- No minimum Monthly or Annual Balance Requirements ( Hard to achieve since, the DBS Interest rates are the best! )

- No Account Maintenance Charges

- Free NEFT & IMPS (UPI) based Transfers . (You again save a lot here in transaction charges)

- Live Phone and Chat Support

- Low Forex Transaction Conversion Charges for International Transactions

DBS is able to provide these services and higher interest rates as it has only a few ATMs throughout the country, hence it saves on the rental, electricity, security costs . Also, since DBS Debit Card can be used at any ATM in the whole country as well as abroad.

Offer

DBS bank is giving back Rs.250 on Debit Card Spends of Rs.2000 for new customers registering via us. Simply enter your details below to get the Exclusive Invite.

[contact-form-7 id=”57″ title=”Contact form 1″]

Besides, the above using a credit card can add extra 0.5% to your Salary per month. Read on the article on how using a credit card carefully can earn you the extra income!